China's Tire Industry Trends

China’s Tire Industry Trends

Tire technology international reports several trends on Tire industry.

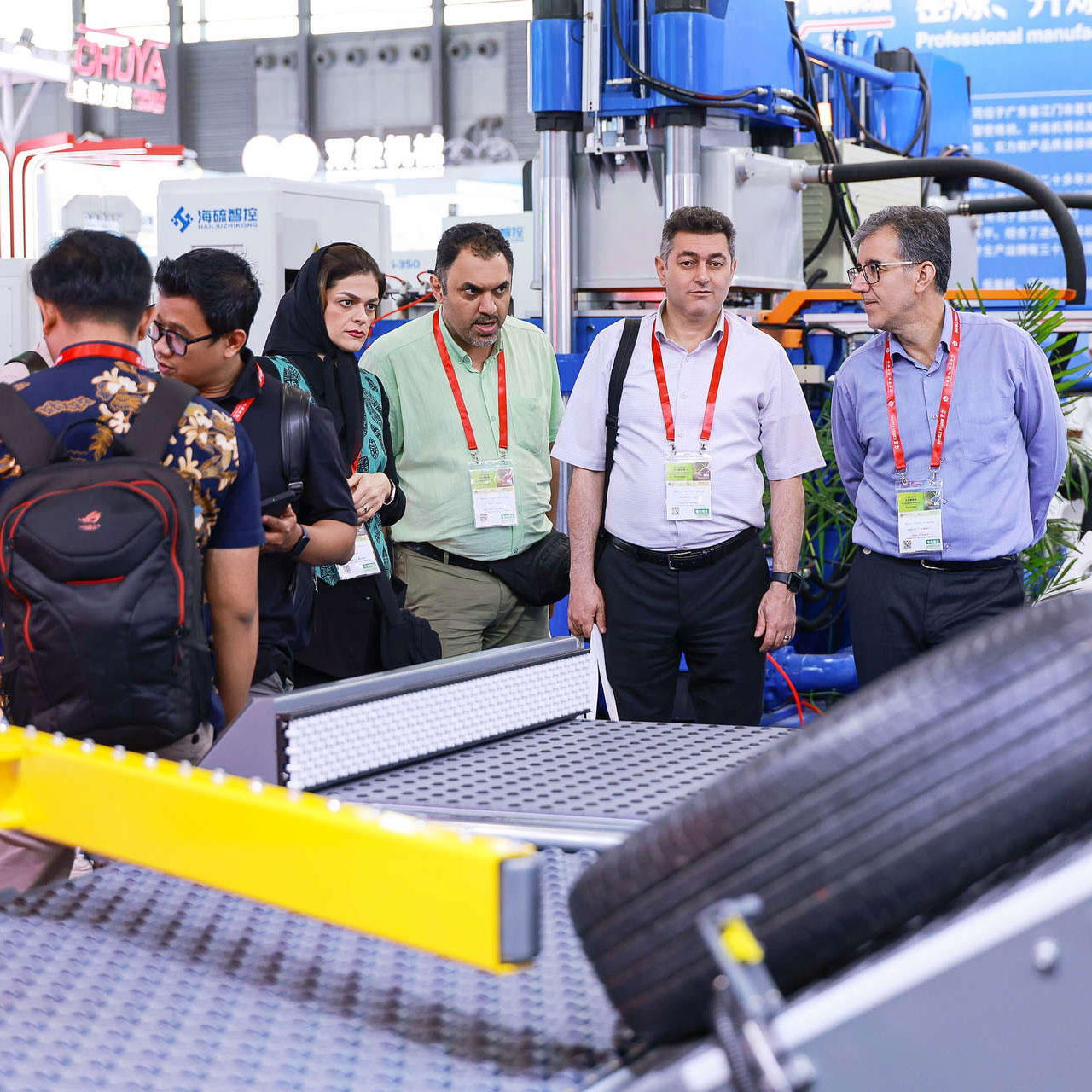

Chinese tire makers may soon genuinely trouble the establishment, as they restructure and step up their R&D game, according to David Shaw, CEO of Tire Industry Research and expert on China’s tire industry, presenting on this subject at the Tire Technology Expo Conference.

China’s tire industry today

The Chinese tire industry is going through a revolution in terms of structure and investment and overseas marketing.

In China, it is in a constant state of turmoil. However, that turmoil has been especially strong in the past 18 months or so, driven by a range of different factors.

The first major change has been the duties imposed on TBR tire exports from China by the USA, Europe, India and other countries. The reaction to this has been threefold. Firstly, some of bigger companies have set up factories in Thailand, Vietnam and elsewhere – Linglong is currently in the process of building a large factory in Serbia.

Secondly, the Chinese tire companies have adopted a much more aggressive marketing strategy in the Middle East, Central and South America, Australia, Japan and other countries that have not yet imposed similar duties.

Thirdly, one of key driver of change in China is the state-managed restructuring of the supply-side economy. Across China, upstream industries are going through a transformation. With the current 13th and upcoming 14th five-year plan under President Xi Jinping, the country is systematically purging the smaller, lower-technology companies that grew up during the rapid expansion phase. These are largely being replaced by highly automated factories operated by larger, more sophisticated companies. Linglong, Prinx Chengshan, Aeolus, Zhongce, Doublestar, Double Coin and a few others are likely to be the big winners in this restructuring. These companies are recruiting tire engineers from global markets to enable them to make tires that compete effectively with the premium and mid-range brands globally.

The impact on the international tire industry

Along with this increase in quality will come an increase in costs, as the Chinese tire makers operate in a larger number of countries and increase their marketing and R&D budgets. Prices will nonetheless remain competitive.

The result will be that the China-based tire makers will offer a genuinely attractive price-performance ratio in all sectors – from cars and trucks to mining and agricultural.

Aeolus, Giti, and other tire makers with roots in China copy move toward intelligent tire business models and seeking to offer services and added value to fleets.

In short, tyre is going to be a competitive market over the coming decade.

热门新闻